How Much Sales Tax Do You Pay On A Used Car In Arkansas . Vehicles priced under $4,000 are exempt from sales tax. do i have to pay sales tax on a used car in arkansas? when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. accurately determine the amount of state sales tax applicable to your state transactions. Assess & pay property taxes. act 1232 of 1997 as amended by act 277 of 2021 provides for a sales and use tax credit for new and used motor vehicles, trailers,. when purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to.

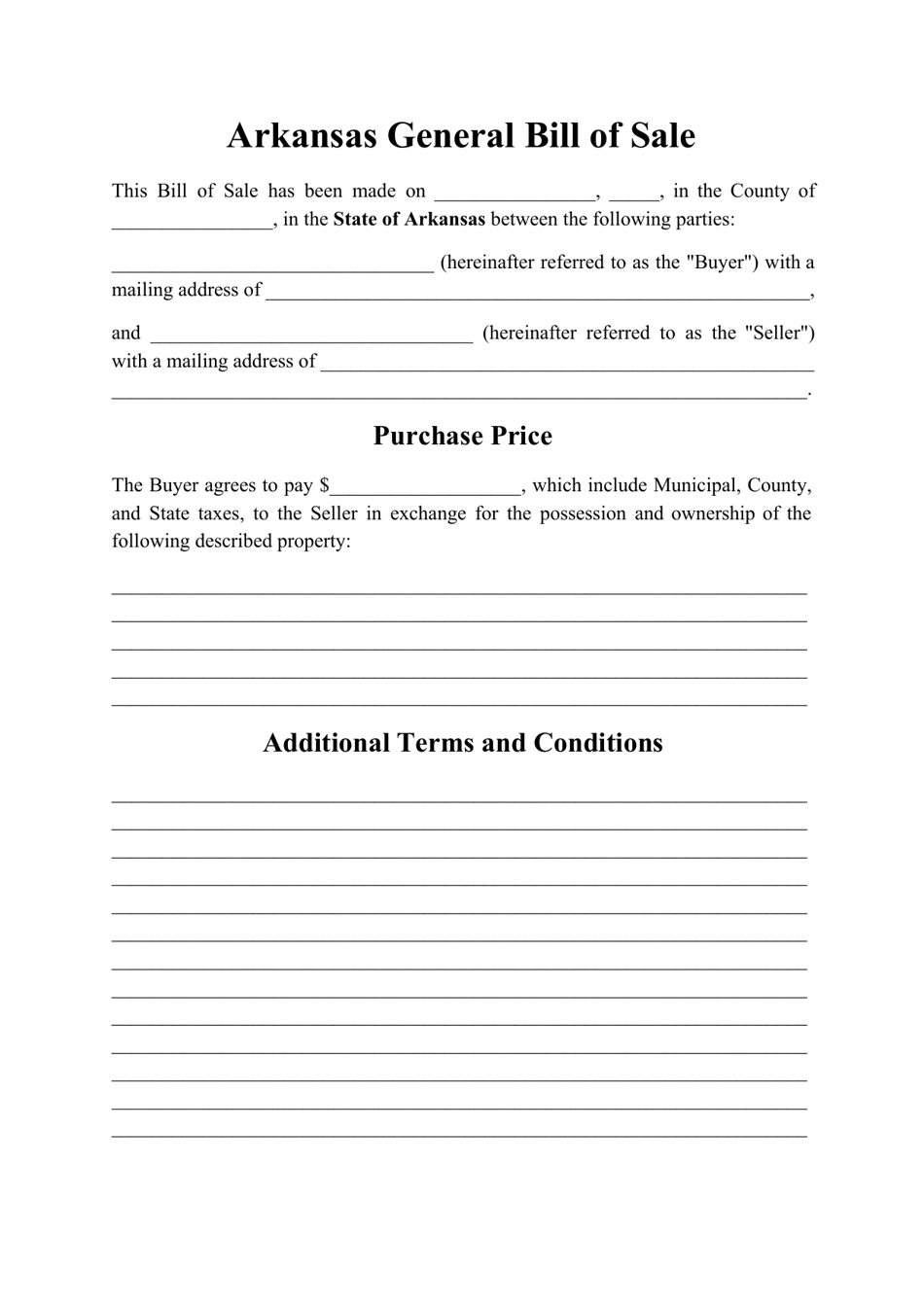

from www.templateroller.com

act 1232 of 1997 as amended by act 277 of 2021 provides for a sales and use tax credit for new and used motor vehicles, trailers,. Assess & pay property taxes. when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. when purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to. Vehicles priced under $4,000 are exempt from sales tax. accurately determine the amount of state sales tax applicable to your state transactions. do i have to pay sales tax on a used car in arkansas?

Arkansas Generic Bill of Sale Form Fill Out, Sign Online and Download

How Much Sales Tax Do You Pay On A Used Car In Arkansas when purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to. when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. when purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to. accurately determine the amount of state sales tax applicable to your state transactions. Assess & pay property taxes. Vehicles priced under $4,000 are exempt from sales tax. do i have to pay sales tax on a used car in arkansas? act 1232 of 1997 as amended by act 277 of 2021 provides for a sales and use tax credit for new and used motor vehicles, trailers,.

From www.bankrate.com

Do You Pay Sales Tax On Used Cars? How Much Sales Tax Do You Pay On A Used Car In Arkansas Assess & pay property taxes. Vehicles priced under $4,000 are exempt from sales tax. when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. accurately determine the amount of state sales tax applicable to your state transactions. do i have to pay sales tax on a. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From formzoid.com

Free Fillable Arkansas Vehicle Bill of Sale Form ⇒ PDF Templates How Much Sales Tax Do You Pay On A Used Car In Arkansas act 1232 of 1997 as amended by act 277 of 2021 provides for a sales and use tax credit for new and used motor vehicles, trailers,. Vehicles priced under $4,000 are exempt from sales tax. accurately determine the amount of state sales tax applicable to your state transactions. do i have to pay sales tax on a. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From taxfoundation.org

Sales Tax Reliance How Much Does Your State Rely on Sales Taxes? How Much Sales Tax Do You Pay On A Used Car In Arkansas do i have to pay sales tax on a used car in arkansas? Vehicles priced under $4,000 are exempt from sales tax. Assess & pay property taxes. accurately determine the amount of state sales tax applicable to your state transactions. when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From printablethereynara.z14.web.core.windows.net

State And Local Sales Tax Rates 2020 How Much Sales Tax Do You Pay On A Used Car In Arkansas Assess & pay property taxes. act 1232 of 1997 as amended by act 277 of 2021 provides for a sales and use tax credit for new and used motor vehicles, trailers,. when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. do i have to pay. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From azexplained.com

When Trading A Car What Is Sales Tax? AZexplained How Much Sales Tax Do You Pay On A Used Car In Arkansas when purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to. when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. do i have to pay sales tax on a used car in arkansas?. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From dl-uk.apowersoft.com

Arkansas Bill Of Sale Printable How Much Sales Tax Do You Pay On A Used Car In Arkansas when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. when purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to. Vehicles priced under $4,000 are exempt from sales tax. Assess & pay property taxes.. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From www.templateroller.com

Arkansas Generic Bill of Sale Form Fill Out, Sign Online and Download How Much Sales Tax Do You Pay On A Used Car In Arkansas when purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to. accurately determine the amount of state sales tax applicable to your state transactions. do i have to pay sales tax on a used car in arkansas? Vehicles priced under $4,000 are exempt from sales. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From www.templateroller.com

Arkansas Vehicle Bill of Sale (Credit for Vehicle Sold) Fill Out How Much Sales Tax Do You Pay On A Used Car In Arkansas when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. Vehicles priced under $4,000 are exempt from sales tax. do i have to pay sales tax on a used car in arkansas? Assess & pay property taxes. accurately determine the amount of state sales tax applicable. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From forms.legal

Bill of Sale Arkansas Download BOS Template Form for Vehicle How Much Sales Tax Do You Pay On A Used Car In Arkansas do i have to pay sales tax on a used car in arkansas? accurately determine the amount of state sales tax applicable to your state transactions. Assess & pay property taxes. Vehicles priced under $4,000 are exempt from sales tax. when purchasing a new car in arkansas, you can use this calculator to determine the exact amount. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From billofsale.net

Free Arkansas Motor Vehicle Commission Bill of Sale Form PDF Word How Much Sales Tax Do You Pay On A Used Car In Arkansas Assess & pay property taxes. when purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to. accurately determine the amount of state sales tax applicable to your state transactions. Vehicles priced under $4,000 are exempt from sales tax. act 1232 of 1997 as amended by. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From old.sermitsiaq.ag

Printable Arkansas Auto Bill Of Sale How Much Sales Tax Do You Pay On A Used Car In Arkansas Assess & pay property taxes. Vehicles priced under $4,000 are exempt from sales tax. when purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to. act 1232 of 1997 as amended by act 277 of 2021 provides for a sales and use tax credit for new. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From www.livemint.com

How much tax do you pay on your investments? Mint How Much Sales Tax Do You Pay On A Used Car In Arkansas when purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to. accurately determine the amount of state sales tax applicable to your state transactions. Assess & pay property taxes. Vehicles priced under $4,000 are exempt from sales tax. when making a car purchase in arkansas,. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From www.youtube.com

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales How Much Sales Tax Do You Pay On A Used Car In Arkansas act 1232 of 1997 as amended by act 277 of 2021 provides for a sales and use tax credit for new and used motor vehicles, trailers,. Vehicles priced under $4,000 are exempt from sales tax. when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. do. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From taxsaversonline.com

Do You Have to Pay Sales Tax on Used Car? How Much Sales Tax Do You Pay On A Used Car In Arkansas do i have to pay sales tax on a used car in arkansas? Vehicles priced under $4,000 are exempt from sales tax. when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. Assess & pay property taxes. accurately determine the amount of state sales tax applicable. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From ceamofmp.blob.core.windows.net

Do I Have To Pay Taxes On The Sale Of A Used Car at Mario Smith blog How Much Sales Tax Do You Pay On A Used Car In Arkansas act 1232 of 1997 as amended by act 277 of 2021 provides for a sales and use tax credit for new and used motor vehicles, trailers,. do i have to pay sales tax on a used car in arkansas? Assess & pay property taxes. accurately determine the amount of state sales tax applicable to your state transactions.. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From formspal.com

Free Arkansas Bill of Sale Forms FormsPal How Much Sales Tax Do You Pay On A Used Car In Arkansas Assess & pay property taxes. Vehicles priced under $4,000 are exempt from sales tax. when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. do i have to pay sales tax on a used car in arkansas? when purchasing a new car in arkansas, you can. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates How Much Sales Tax Do You Pay On A Used Car In Arkansas when purchasing a new car in arkansas, you can use this calculator to determine the exact amount of sales tax you need to. act 1232 of 1997 as amended by act 277 of 2021 provides for a sales and use tax credit for new and used motor vehicles, trailers,. Vehicles priced under $4,000 are exempt from sales tax.. How Much Sales Tax Do You Pay On A Used Car In Arkansas.

From www.dochub.com

Arkansas car sales tax payment plan Fill out & sign online DocHub How Much Sales Tax Do You Pay On A Used Car In Arkansas accurately determine the amount of state sales tax applicable to your state transactions. when making a car purchase in arkansas, you’ll pay 6.5% of the vehicle’s purchase price, whether you’re buying from a private. act 1232 of 1997 as amended by act 277 of 2021 provides for a sales and use tax credit for new and used. How Much Sales Tax Do You Pay On A Used Car In Arkansas.